Imagine receiving a call from your bank urging you to update your Know Your Customer (KYC) details immediately or risk having your account blocked. The caller sounds professional, the request seems urgent, and before you know it, you’ve shared your confidential details—only to realize later that your bank account has been drained.

Welcome to the rising menace of KYC fraud, where scammers manipulate identity verification procedures to steal money and sensitive information. With financial fraud cases increasing by 30% in 2023 (as per RBI reports), understanding and preventing KYC fraud is more critical than ever.

Let's dive into what KYC fraud is, how it happens, and the best ways to protect yourself.

What is KYC and Why is it Important?

KYC (Know Your Customer) is a legally mandated identity verification process used by banks, financial institutions, and businesses to verify the authenticity of their customers.

Purpose of KYC:

✔ Prevent money laundering and financial fraud.

✔ Identify and stop fraudulent transactions.

✔ Ensure compliance with banking regulations.

Fact: According to the Reserve Bank of India (RBI), over 14,000 cases of banking fraud were reported in 2022-2023, with losses exceeding ₹30,000 crores. A significant portion of these cases involved KYC fraud.

How Do KYC Frauds Work?

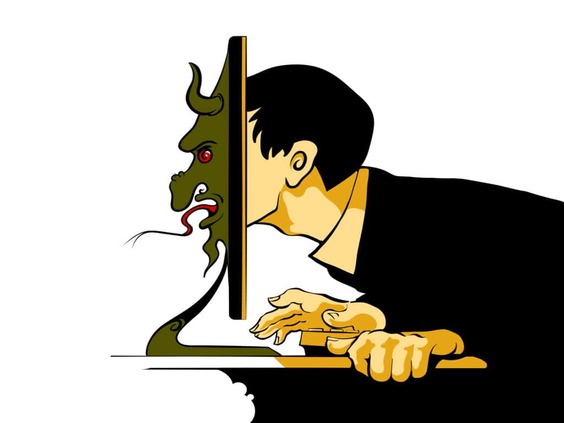

Cybercriminals use various tactics to exploit KYC verification processes and deceive unsuspecting individuals. Here’s how they operate:

1. Fake Calls & SMS Scams

Fraudsters impersonate bank representatives or payment wallet companies, sending alarming messages that say:

✔ “Your KYC is about to expire. Update immediately to avoid account suspension.”

✔ “Click this link to complete KYC verification or risk losing access to your funds.”

Once victims click the link or share details, scammers steal their credentials and gain unauthorized access to bank accounts.

2. Fake KYC Verification Apps

Scammers trick users into downloading fake banking or UPI apps, which are designed to steal login credentials, passwords, and OTPs.

Example: Recently, cybercriminals created a fake "Aadhaar KYC" app that installed malware, compromising users’ financial details.

3. Social Engineering Attacks

Fraudsters manipulate emotions—fear, urgency, or excitement—to extract sensitive information. They pretend to be:

✔ Bank employees

✔ Customer support agents

✔ Government officials

By building false trust, they trick people into revealing personal details, allowing them to execute financial frauds.

Warning Signs of KYC Frauds

Be cautious if you notice these red flags:

1. Calls or messages asking for banking details, OTPs, or passwords.

2. Urgent or threatening language claiming immediate action is required.

3. Poorly written messages with grammatical errors.

4. Links to unknown or suspicious websites.

5. Requests to download third-party apps for KYC verification.

Fact: According to CERT-In (Indian Computer Emergency Response Team), over 50% of online banking frauds originate from phishing scams where users unknowingly share sensitive data.

How to Stay Safe from KYC Frauds?

1. Never Share Confidential Information

Banks or financial institutions never ask for passwords, OTPs, or CVVs over calls, SMS, or emails.

If someone demands sensitive details, immediately disconnect the call and verify with your bank.

2. Do Not Click on Suspicious Links

Avoid clicking on links received via SMS, emails, or WhatsApp messages related to KYC updates.

Instead, visit the official website of your bank or contact customer support directly.

3. Use Only Official Banking Apps

Always download banking and payment apps from trusted sources like Google Play Store or Apple App Store.

Never install third-party apps claiming to provide instant KYC verification services.

4. Enable Two-Factor Authentication (2FA)

Two-factor authentication (2FA) adds an extra layer of security to your banking apps.

Even if scammers get your password, 2FA ensures they cannot access your account without a secondary verification.

5. Verify Callers Before Sharing Information

If someone claims to be from your bank, verify their identity by calling the official customer support number.

Never trust unsolicited calls or messages. Scammers often use spoofed phone numbers to appear legitimate.

6. Report Suspicious Activity Immediately

If you suspect fraud, act quickly:

1. Inform your bank or financial institution.

2. File a complaint on the National Cyber Crime Portal (www.cybercrime.gov.in).

3. Call 1930 (cybercrime helpline) to report the incident.

Fact: The faster you report a financial fraud case, the higher the chances of recovering lost money.

Real-Life KYC Fraud Case Study

In July 2023, a Mumbai-based businessman lost ₹12 lakhs after receiving a KYC update request from a fake bank executive.

🔹 He received a message stating, “Your KYC has expired. Click the link to update or risk account suspension.”

🔹 Believing it to be real, he entered his banking details and OTP.

🔹 Within minutes, fraudsters transferred his entire savings to multiple accounts.

Lesson: Banks never send KYC update links via SMS. Always verify before acting.

Conclusion: Stay Alert, Stay Safe!

KYC fraud is a growing cyber threat, but awareness and caution can keep you safe. Scammers prey on urgency and fear, so always take a moment to verify before taking any action.

Final Tip: "Think before you click. If something feels suspicious, it probably is.

Stay vigilant. Stay secure. Protect your digital identity.

Cyber Hygiene Community

- TeachersOnlineSafety CyberAwareEducators DigitalSafetyForTeachers EdTechSecurity TeacherCyberSafety CyberAwareness CyberSafety SafeInternetForAll CyberHygieneForAll

You May Also Like It

The internet has transformed the way children learn, play, and

Instant messaging (IM) platforms have become indispensable for communication in

Leave A Comment

Don’t worry ! your e-mail address will not published.

0 Comments