In today's interconnected world, One-Time Passwords (OTPs) play a vital role in securing online transactions and communications. These dynamic codes serve as an additional layer of authentication, ensuring only authorized individuals can access sensitive accounts and complete financial operations. However, as digital transactions increase, cybercriminals have developed sophisticated methods to exploit OTPs, posing significant risks to users' financial security.

This guide delves into what OTP fraud entails, how it happens, and the actionable steps you can take to protect yourself from falling victim.

What is OTP Fraud?

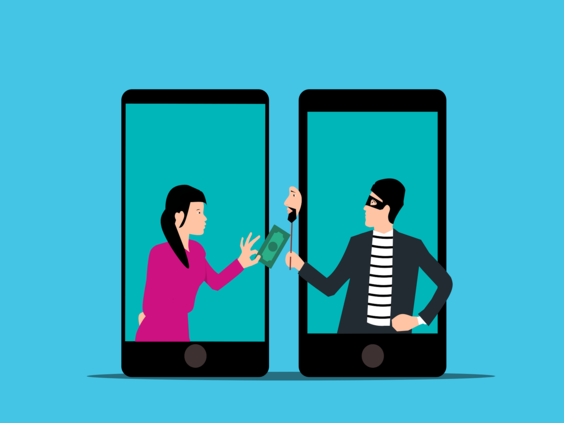

OTP fraud occurs when cybercriminals trick individuals into sharing their OTPs. These codes, designed to be secure and valid for a single transaction or session, can grant fraudsters unauthorized access to financial accounts and sensitive data if obtained.

The consequences of OTP fraud include:

- Financial Loss: Fraudsters can transfer funds or make unauthorized purchases.

- Identity Theft: Criminals may use stolen credentials to impersonate victims.

- Emotional Distress: Victims often feel violated and helpless after such incidents.

Understanding the techniques used by fraudsters is the first step to staying protected.

How OTP Theft Happens

Cybercriminals rely on manipulation and deception to access OTPs. Their tactics are often highly persuasive, exploiting human trust and urgency.

1. Impersonation and Deception

- Over the Phone: Fraudsters impersonate bank officials, customer care executives, or even government representatives to gain trust.

- In-Person Scams: Criminals use fake identities or fabricated stories to convince victims to share OTPs.

- Malware Links: Victims unknowingly click on malicious links, allowing fraudsters to intercept OTPs.

2. Common Scenarios Exploited by Fraudsters

- Promises of free gifts, discounts, or cashback offers.

- Fake loan approvals or credit limit increases.

- Claims of needing to complete KYC verification.

- False order confirmations or cancellations from shopping platforms.

3. Modus Operandi of Fraudsters

- Fake Calls: Fraudsters call victims, often with convincing scripts, to request OTPs under false pretences.

- Malware Attacks: Clicking on fraudulent links installs software that captures sensitive data, including OTPs.

- Social Engineering: Criminals manipulate victims emotionally or psychologically, making them believe sharing an OTP is harmless or necessary.

Example Scenario

A scammer poses as a representative from an e-commerce platform, claiming that an unrecognized order has been placed under the victim’s account. The scammer asks the victim to cancel the order by sharing the OTP received. Once shared, the fraudster uses it to complete unauthorized transactions, leaving the victim unaware until it’s too late.

How to Prevent OTP Fraud

Staying vigilant and adopting proactive measures is crucial to safeguarding your financial security. Here are the best practices:

1. Never Share OTPs

- Legitimate organizations, including banks and e-commerce platforms, will never ask for OTPs, PINs, or CVVs.

- Treat OTPs as confidential as your ATM PIN or password.

2. Beware of Unverified Links

- Avoid clicking on links received from unknown senders.

- Double-check URLs to ensure they are from official sources.

3. Verify Communications

- Always contact service providers directly using official numbers listed on their websites, not the ones provided in messages or emails.

- If you receive a suspicious call, end it immediately and confirm its authenticity with the organization.

4. Limit App Permissions

- Be cautious when downloading third-party apps. Grant permissions only when absolutely necessary.

- Regularly review and revoke unnecessary app permissions on your device.

5. Avoid Screen Sharing Apps

- Do not install screen-sharing tools like AnyDesk or TeamViewer unless you’re certain of the requester's identity and purpose.

6. Dispose of Sensitive Documents Properly

- Shred or securely dispose of old bank statements, expired cards, and documents containing sensitive information to prevent misuse.

7. Monitor Your Messages and Accounts

- Keep a close eye on your SMS and email notifications for OTPs or suspicious activity.

- Immediately report unauthorized transactions or OTP requests to your bank or service provider.

8. Enable Account Safeguards

- Use two-factor authentication wherever possible.

- Set transaction alerts to stay informed of account activity in real time.

What to Do if You’re a Victim of OTP Fraud

If you suspect or confirm that you’ve been targeted, act quickly:

1. Contact Your Service Provider

Inform your bank or service provider immediately. Request to block your account or card to prevent further misuse.

2. Report to Authorities

- File a complaint with your local Cyber Crime Police Station.

- Submit an online report via the official cybercrime portal at cybercrime.gov.in.

- Call the toll-free helpline number 1930 to report fraud.

3. Preserve Evidence

- Save screenshots of suspicious messages, emails, or transactions.

- Record the details of fraudulent calls, including the caller's number and the conversation.

4. Monitor Your Accounts

Continue monitoring your financial accounts and credit reports for unusual activity even after reporting the incident.

Final Thoughts: Stay Alert, Stay Safe

As digital convenience grows, so does the ingenuity of cybercriminals. While OTPs are a reliable security measure, their effectiveness depends on how carefully they are handled. By staying informed and adopting best practices, you can significantly reduce the risk of falling prey to OTP fraud.

Remember, vigilance is your best defence. If in doubt, err on the side of caution—don’t share sensitive information, click on unverified links, or trust unsolicited communications.

By staying informed and adopting best practices, you can significantly reduce the risk of falling prey to OTP fraud.

Cyber Hygiene Community

- InfosecProfessionals TechCyberProtection CyberSecureStartups CyberAwareness CyberSafety PersonalDataProtection SafeInternetForAll CyberHygieneForAll CyberSecurityForSMBs CyberHygieneForSMBs

You May Also Like It

In the fast-paced world of Kenyan business, data is gold.

In today's digital age, Kenya's national security is no longer

Leave A Comment

Don’t worry ! your e-mail address will not published.

0 Comments